The Ultimate Guide on How to Pick Your Credit Card in Japan

- Why Trust Us

Our comparison service is NOT compensated by any credit card company. Our editorial team and our expert review board provide an unbiased analysis of the products we feature. We use stars rating method that is based on local Japanese feedback.

On this Page

Whether you are a student or a salaryman with many years of experiences, you can find the most appropriate card that fits your expectation here.

Understand Your Spending Habits

Identify where you spend most of your money. Are you frequently shopping at コンビニ (convenience stores), dining out, traveling, or using public transportation?

Your spending habits will dictate which credit card will offer the most rewards and benefits.

Types of Credit Cards in Japan

- 一般目的カード (General Purpose Cards): Suitable for a variety of spending, these cards often provide points or cashback for every purchase.

- 店専用カード (Store-Specific Cards): Ideal if you frequently shop at specific retailers like 楽天 (Rakuten) or Amazon Japan.

- 旅行カード (Travel Cards): Best for those who travel often, offering rewards like airline miles, travel insurance, and 空港ラウンジ (airport lounge) access.

- ライフスタイルカード (Lifestyle Cards): Tailored to specific lifestyles, such as cards that offer rewards for dining, entertainment, or 公共交通機関 (public transport).

Key Features to Consider

- 年会費 (Annual Fees): Some cards have annual fees which may be justified by the benefits they offer. Compare these to fee-free cards.

- ポイント還元率 (Reward Rates): Look for cards that offer high reward rates in categories where you spend the most.

- 入会ボーナス (Sign-Up Bonuses): Many cards offer significant sign-up bonuses. Ensure you can meet the spending requirements to qualify.

- 海外取引手数料 (Foreign Transaction Fees): If you travel or shop internationally, look for cards that waive foreign transaction fees.

- 追加のメリット (Additional Benefits): Consider cards that offer extras such as travel insurance, purchase protection, and concierge services.

Popular Credit Card Providers in Japan

JCB: Known for extensive acceptance in Japan and attractive reward programs.

三井住友 (Mitsui Sumitomo): Offers a range of cards including the popular 三井住友カード (NL) with excellent rewards for daily spending.

楽天カード (Rakuten): Ideal for frequent shoppers on Rakuten with high points accumulation.

アメリカン・エキスプレス (American Express): Provides premium benefits and services, albeit with higher annual fees.

Transition Paragraph for Your Credit Card Directory

Navigating the myriad of credit card options available in Japan can be daunting.

Our comprehensive directory simplifies this process, categorizing cards based on specific benefits, usage patterns, and unique features tailored for different lifestyles.

Whether you prioritize rewards for daily purchases, travel perks, or specialized store discounts, our directory is designed to help you find the perfect card that aligns with your financial goals and habits.

Explore our curated selections and make informed decisions with ease, ensuring you get the most out of your credit card choices in Japan.

All 500 Japanese credit card directory

Welcome to our exclusive credit card directory for Japan!

This partial preview showcases some of the top credit card options tailored to diverse needs, from daily spending rewards to travel perks and store-specific discounts.

To explore the entire directory and find the perfect card that matches your financial goals and lifestyle, simply click here for full access. Our detailed comparisons and expert insights will guide you to make the best-informed decision for your credit card needs in Japan.

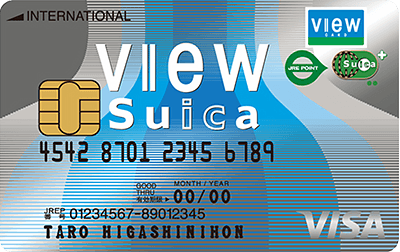

- Fee: 524

- Cashback: 5.0% (high end)

- This card comes with auto-charge and a commuter pass, and accumulated points can be exchanged for Suica.

- Fee: free

- Cashback: 3.0% (high end)

- This is a View Card with Suica functionality and no annual fee, available for revolving payments only.

- Fee: free

- Acom's MasterCard can issue your card on the same day and also allows you to use it for card loans.

- Fee: 2624

- Cashback: 3.0% (high end)

- This card gives members a 5% discount on ticket prices on JR East and JR Hokkaido lines.

- Fee: 4364

- Cashback: 3.0% (high end)

- This card gives members a 30% discount on ticket prices on JR East and JR Hokkaido lines.

- Fee: free

- Cashback: 1.0% (high end)

- AEON Card is no longer accepting new applications.

How to Apply for a Credit Card in Japan as a Foreigner

Step-by-Step Guide:

- Gather Required Documents: Typically, you’ll need your residence card, passport, proof of income (or student status), and possibly a Japanese bank account.

- Choose the Right Card: Based on your needs and the benefits listed above.

- Complete the Application: Many cards offer online applications in English. Ensure all information is accurate.

- Wait for Approval: This can take from a few days to a few weeks. Some banks might request additional information.

- Receive Your Card: Once approved, your card will be mailed to your registered address.