500 Best Credit Cards in Japan 2024

- Why Trust Us

Our comparison service is NOT compensated by any credit card company. Our editorial team and our expert review board provide an unbiased analysis of the products we feature. We use stars rating method that is based on local Japanese feedback.

Airline

- Fly Miles

Select by features

- Milage

- Student

- Business

- Reward

Select by Card class

GOld

"Airport Lounges Access"

Platinum

"High Social Status Card"

all cards

"Browse All Crads"

PR Available

Featured cards

PR Available

Use case

- ANA

- JAL

- Business

- Student

- Foreigner friendly

Search Keywords

All Japanese credit cards directory

三井住友カード(カードレス)

SAISON CARD Digital

Fee: free

Cashback: 1.0%

JCBプラチナ

Fee: 27500

Cashback: 10.0%

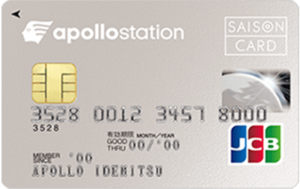

apollostation card(アポロステーションカード)

Fee: free

Cashback: 0.5%

JALカード CLUB-Aゴールドカード

Fee: 17600

Cashback: 2.0%

P-one カード<Standard>

Fee: free

Cashback: 1.0%

ウエルシアカード

Fee: free

Cashback: 2.0%

Oliveフレキシブルペイ

Fee: free

Cashback: 7.0%

イオンカード(ミニオンズ)

Fee: free

Cashback: 1.0%

セブンカード・プラス

Fee: free

Cashback: 1.0%

Conclusion

Choosing the right credit card in Japan can greatly enhance your financial flexibility and offer valuable rewards tailored to your lifestyle.

Whether you’re looking for cards with cashback benefits, travel rewards, or low-interest rates, it’s essential to compare various options to find the one that best suits your needs.

For instance, the JCB Platinum card offers exclusive travel rewards and concierge services, making it ideal for frequent travelers.

If you prefer cashback, the 楽天カード allows you to earn Rakuten points on every purchase, which can be redeemed for various products and services. For those who shop at AEON malls, the イオンカード provides discounts and rewards at AEON stores.

Additionally, the 三井住友カード ゴールド offers robust rewards for dining and shopping, along with comprehensive travel insurance. It’s also beneficial to check your credit score regularly through services like JICC or CIC, as a higher score can qualify you for more premium credit cards.

Don’t forget to explore cards with no annual fees, such as the Orico Card THE POINT, which offers high point returns on purchases.

By visiting comprehensive comparison sites like ポイ探 and クレジットカードの読みもの, you can further explore the benefits and drawbacks of each card.

Understanding the terms and benefits of each card can help you make an informed decision and optimize your financial health.

FAQ

-

What are the best credit cards in Japan for foreigners?

Some of the best credit cards in Japan for foreigners include the Rakuten Card, Sony Bank WALLET, and the JCB EIT Card. These cards offer various benefits like no annual fees, cashback, and rewards points. Additionally, they are relatively easier for foreigners to apply for and get approved.

-

How can I apply for a credit card in Japan as a foreigner?

To apply for a credit card in Japan as a foreigner, you typically need to provide identification (such as a residence card), proof of income or employment, and a Japanese bank account. Some credit card companies also require a Japanese phone number and address. Online applications are available for many cards, and some banks offer English application forms.

-

What are the advantages of using a credit card in Japan?

Using a credit card in Japan offers several advantages, including convenience for cashless payments, earning rewards points or cashback, and building a credit history. Additionally, credit cards often provide consumer protection benefits like purchase insurance and fraud protection.

-

Are there any annual fees for credit cards in Japan?

Many credit cards in Japan offer no annual fees, especially popular ones like the Rakuten Card and the JCB EIT Card. However, premium credit cards with more benefits, such as the American Express Gold Card or the JCB Gold Card, may have annual fees ranging from ¥10,000 to ¥30,000 or more.

-

How do I earn and redeem credit card points in Japan?

Credit card points in Japan can be earned by using your card for everyday purchases. Each credit card company has its own rewards program, such as Rakuten Points, T-Points, or ANA Mileage Club. Points can be redeemed for various rewards, including gift cards, discounts on purchases, travel miles, and even cash back.