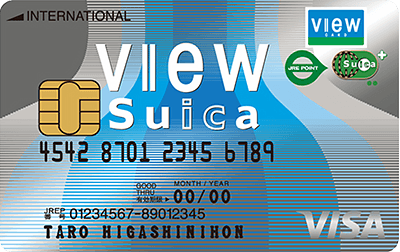

You can earn 5 points for every 1,000 yen you spend on shopping, and 15 points for every 1,000 yen you spend on auto-charge. The points you earn can be used to charge your Suica, or exchanged for gifts or gift certificates. You can also earn bonus points based on your annual usage. Overseas travel insurance with a maximum limit of 5 million yen is included.