150+ Best Credit Cards For Foreigners in Japan

- Why Trust Us

Our comparison service is NOT compensated by any credit card company. Our editorial team and our expert review board provide an unbiased analysis of the products we feature. We use stars rating method that is based on local Japanese feedback.

On this Page

Why Get a Credit Card in Japan?

Credit Card Etiquette

For people who are trying to learn how to communicate in Japanese when using a credit card, Coto Japanese Language School has a really good article for you to learn the Japanese language. You can find the article here.

Top Credit Cards for Foreigners in Japan

1. Rakuten Card

Why It’s Great:

No Annual Fee: Free for life.

Generous Rewards: Earn 1% cashback on all purchases.

Easy Application: Straightforward online application process, available in English.

Wide Acceptance: Accepted at Rakuten Ichiba and numerous other merchants.

Ideal For:

Online shoppers and those who want a hassle-free application process.

- Fee: free

- Cashback: 3.0% (high end)

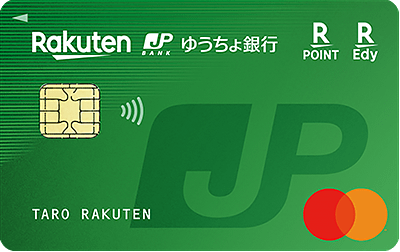

- This is a Japan Post Bank affiliated card that allows you to earn Rakuten points.

- Fee: free

- Cashback: 3.0% (high end)

- This card comes with a built-in cash card and doubles the interest rate on regular savings accounts.

- Fee: 550

- Cashback: 3.0% (high end)

- If you use it once a year, there is no annual fee. You can also earn ANA miles with this Rakuten Card.

2. JAL Card

Why It’s Great:

Mileage Program: Earn miles for every purchase, which can be used for flights and upgrades.

Travel Benefits: Various travel-related perks, including free checked baggage and priority boarding.

Special Offers: Regular promotions and discounts for JAL Card holders.

Ideal For:

Frequent flyers and those who travel often within Japan and internationally.

- Fee: 2200

- Cashback: 2.0% (high end)

- This card is available only to people in their 20s and adds special services to the regular JAL card.

- Fee: 2200

- Cashback: 1.0% (high end)

- In addition to the basic functions of the JAL Card, this card also allows you to use Tokyu Group services.

- Fee: 34100

- Cashback: 3.0% (high end)

- This card offers JAL CLUB EST services as well as Platinum member benefits.

- Fee: 17600

- Cashback: 2.0% (high end)

- This card offers the functions of a CLUB-A Gold Card and allows you to use Tokyu Group services.

- Fee: 2200

- Cashback: 1.0% (high end)

- In addition to the basic functions of a JAL card, this card also allows you to accumulate Odakyu points.

- Fee: 11000

- Cashback: 1.0% (high end)

- This is a JAL card that allows you to earn more miles when flying than a regular card.

3. MUFG Card

Why It’s Great:

Flexible Eligibility: Easier for foreigners with short-term residency.

Comprehensive Benefits: Travel insurance, rental car insurance, and purchase protection.

Rewards Program: Earn points on all purchases, which can be redeemed for a variety of rewards.

Ideal For:

Individuals looking for a card with extensive travel and purchase protection benefits.

- Fee: 16500

- Cashback: 1.5% (high end)

- This is a gold card that allows you to earn United Airlines mileage points.

- Fee: 16500

- Cashback: 1.5% (high end)

- This is a United Airlines Gold Card that allows you to earn MileagePlus points.

- Fee: 30800

- This is a platinum card that offers comprehensive domestic and international insurance and makes it easy to accumulate miles.

4. View Suica Card

Why It’s Great:

Transportation Integration: Combines a credit card with the Suica transportation card.

Convenience: Perfect for daily commuters in Japan.

Bonus Points: Earn JR East points on all Suica charges and purchases.

Travel Insurance: Includes travel accident insurance.

Ideal For:

Daily commuters and those who frequently use Japan Railways.

- Fee: 524

- Cashback: 10.0% (high end)

- This card gives you a basic 10% Bic Points when you use Bic Camera.

- Fee: 524

- Cashback: 5.0% (high end)

- This is a View Card that has Suica functionality and allows you to accumulate JRE POINTS.

- Fee: free

- Cashback: 1.0% (high end)

- Aeon Card and "Suica" are integrated. This card allows you to use Suica without any deposit.

Whether you are a student or a salaryman with many years of experiences, you can find the most appropriate card that fits your expectation here.

How to Apply for a Credit Card in Japan as a Foreigner

Step-by-Step Guide:

- Gather Required Documents: Typically, you’ll need your residence card, passport, proof of income (or student status), and possibly a Japanese bank account.

- Choose the Right Card: Based on your needs and the benefits listed above.

- Complete the Application: Many cards offer online applications in English. Ensure all information is accurate.

- Wait for Approval: This can take from a few days to a few weeks. Some banks might request additional information.

- Receive Your Card: Once approved, your card will be mailed to your registered address.

Tips for Choosing the Best Credit Card in Japan

Step-by-Step Guide:

Check for Foreign Transaction Fees: Make sure the credit card you choose has low or no foreign transaction fees to save money on international purchases.

Look for English Customer Support: Opt for a card that offers customer service in English. This can be crucial if you need assistance with your account.

Consider Rewards and Benefits: Select a card that offers rewards and benefits that match your spending habits, such as travel points, cash back, or discounts on dining and shopping.

Understand the Application Process: Some credit cards in Japan may have specific requirements for foreigners, such as proof of residency or employment. Ensure you have all necessary documents before applying.

Evaluate the Interest Rates: Compare interest rates across different credit cards. Lower interest rates can help you save money if you plan to carry a balance.

Check for Partner Merchants: Some credit cards offer additional rewards and discounts at specific partner merchants. Look for a card that aligns with your preferred shopping and dining locations.

Read the Fine Print: Carefully review the terms and conditions, including fees, penalties, and the rewards program details, to avoid any surprises.

-

What are the best credit cards for foreigners in Japan?

The best credit cards for foreigners in Japan typically offer benefits such as no foreign transaction fees, English customer support, and rewards tailored to expats and travelers. Examples include the Rakuten Card, American Express Gold Card, and the Shinsei Bank Global Pass Card.

-

What documents do I need to apply for a credit card in Japan as a foreigner?

- A valid residence card

- Passport

- Proof of income (such as a salary slip or tax statement)

- Proof of address (like a utility bill)

-

Can I apply for a Japanese credit card online?

Yes, many Japanese credit cards allow online applications. However, some might require you to visit a bank branch or send additional documents by mail.

-

Are there credit cards in Japan with no annual fees?

Yes, several credit cards in Japan come with no annual fees, such as the Rakuten Card and the Aeon Card. These cards are popular among foreigners for their ease of use and cost-effectiveness.

-

Do Japanese credit cards offer English customer service?

Some Japanese credit cards offer English customer service. American Express, Rakuten Card, and Shinsei Bank are known for providing support in English, which is beneficial for foreigners who are not fluent in Japanese.

-

What are the advantages of using a Japanese credit card for foreigners?

Advantages include:

- No foreign transaction fees on international purchases

- Rewards and points programs tailored for travel and shopping

- Access to special promotions and discounts in Japan

- Building a credit history in Japan

-

How can I increase my chances of credit card approval in Japan?

To increase your chances of approval:

- Ensure you have a stable source of income

- Maintain a good credit history, if applicable

- Provide all required documents accurately

- Consider starting with a card known for easier approval, like the Rakuten Card

-

What is JCB?

JCB is the biggest credit card network company in Japan. JCB USA stopped issuing new JCB cards on January 8, 2018, and closed all existing consumer credit card accounts on April 30, 2018. This was part of JCB's decision to discontinue its direct consumer credit card services in the U.S. market, although JCB cards issued outside the U.S. continue to be accepted through their partnership with the Discover network.